Scenario Generation and Moment Matching

In link, I showed that we could approximate the randomness of a stochastic process using a set of scenarios. A scenario is a potential realization of a multivariate random variable. A large variety of different methods have been suggested for the generation of scenarios. They range from using simple historical returns to more complex methods based on random sampling from historical data (Bootstrap methods) and Monte Carlo simulation, as well as forecasting methods link.

In general, a set of scenarios approximating a stochastic process of financial returns can be described using an index associated to each scenario, with , where is the total number of scenarios. Given assets, a scenario consists of return realizations, one for each asset. The realization is the rate of return of asset under scenario . A portfolio’s expected return and risk is then to be evaluated on mutually exclusive scenarios , each of which occurring with a probability

An inherent problem of scenario generation is the dimensionality of the approximation of the continuous stochastic process. In order to get a good approximation of the underlying process, a large number of scenarios is needed which in turn increases the size of the asset allocation problem. Two overall contrasting approaches exist when addressing this problem, i.e. scenario reduction techniques and moment matching. Both try to reduce the number of scenarios while preserving the overall structure. While both approaches have merits, link compare the two methods in the context of financial optimization, and find (when ensuring the absence of arbitrage in the scenarios) that moment matching provides superior solutions compared to scenario reduction.

The moment matching technique works by approximating the statistical moments (mean, standard deviation, skewness, kurtosis and correlation) of the original set of scenarios using a reduced number of scenarios. The statistical moments are assumed to be the “true” moments of the stochastic process, and the method then seeks to approximate these moments. In practice, this is done by minimizing the squared difference between the “true” moments and the moments of the reduced scenarios. This is in some ways similar to estimating the parameters in linear regression, where we minimize the squared residuals. The moment matching problem can be written as

where denote the “true” statistical moments and denotes the statistical moments of our scenarios. This method can be conveniently implemented in Python using the optimization routines in the excellent SciPy library.

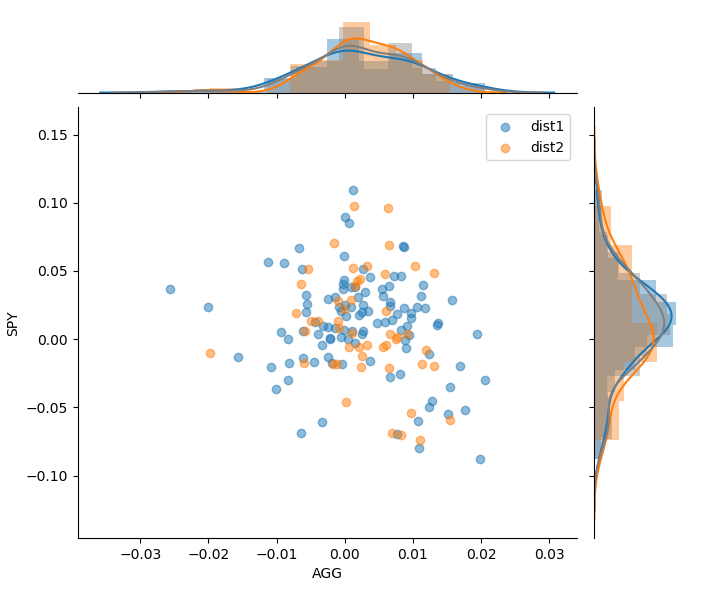

To show the application of the algorithm, let’s download historical price data for S&P500 and an aggregated bond index proxied by the ETFs SPY and AGG. First, I compute the statistical moments: mean, standard deviation, skewness, kurtosis, and covariance. These are assumed to be the “true” moments that we seek to match with N scenarios. We set N = 50, and run the moment matching algoritm. The minimization function requires an initial guess on the starting parametes. We use the multivariante normal distribution as initial guess, which is probably not too far off assuming the we do not have extreme skewness or kurtosis.

The resulting moment matched distribution is plotted below together with the historical monthly returns, where the yellow dots are our moment matched scenarios and the blue dots are the historical returns.

From the density plots and correlation structure, we can observe that our moment matched scenarios are quite close to the original structure, despite only using less than half the amount of scenarios. Though, one problem with this approach remains: the optimization problem is highly non-linear and is quite dependant on having good starting parameters.

Code

Download of Data and CVaR Optimization

import pandas as pd

import numpy as np

from pandas_datareader import data

import seaborn as sns

import matplotlib.pyplot as plt

from scipy.optimize import minimize

from scipy.stats import skew, kurtosis

# We would like all available between these dates.

start_date = '2010-01-01'

end_date = '2018-12-31'

# tickers

tickers = ["SPY","AGG"]

# User pandas_reader.data.DataReader to load the desired data.

panel_data = data.DataReader(tickers, 'yahoo', start_date, end_date)

df_close = panel_data["Adj Close"]

# Daily returns, and remove the first row as it is NA

df_ret = df_close.resample('M').last().pct_change().iloc[1:]

# define "True" moments

mu_ = df_ret.mean().values

std_ = df_ret.std().values

skew_ = df_ret.skew().values

kur_ = df_ret.kurtosis().values

cov_ = df_ret.cov().values

# ini moment matching algorithm

MM = MomentMatch()

# input parameters

Para_match = np.array([mu_,std_,skew_,kur_,[cov_] ])

# find a reduced number of scenarios with approx same statistical moments

MM_scen = MM.MomentMatching(Para_match=Para_match)Functions for moment matching

class MomentMatch:

def MomentMatchingFunc(self,x,Para_match):

""" Moment maching function. Create a discrete approximitation of a finite set of statistical moments using a defined number of scenarios

Parameters

----------

x : dict

Scenarios (variables)

Para_match : numpy array

statistical moments to be matched

Returns

-------

float

returns the error of the approximation

References

----------

.. [1] Hoyland, Kjetil, Michal Kaut, and Stein W. Wallace. A heuristic for moment-matching scenario generation. Computational optimization and applications 24.2-3 (2003): 169-185.

"""

# true moments

exp_mu = Para_match[0]

exp_sds = Para_match[1]

exp_skew = Para_match[2]

exp_kur = Para_match[3]

exp_cov_m = Para_match[4][0]

# get correlation matrix from covariance matrix

std_ = np.sqrt(np.diag(exp_cov_m))

exp_cor_m = exp_cov_m / np.outer(std_, std_)

# create scenarios

xx = np.reshape(x, (-1, len(exp_mu)))

# moments of the scenarios

m1 = np.mean(xx,axis=0)

m2 = np.std(xx,axis=0)

m3 = [skew(xx[:,i]) for i in range(len(exp_mu)) ]

m4 = [kurtosis(xx[:,i]) for i in range(len(exp_mu)) ]

# sum of sum of squared residuals

epsilon = sum( m1 - exp_mu )**2 + sum( m2 - exp_sds)**2 + sum( m3 - exp_skew)**2 + sum( m4 - exp_kur)**2 + sum(sum( (np.corrcoef(xx,rowvar=False)-(exp_cor_m))**2))

return(epsilon)

def MomentMatching(self,Para_match,S_N=50,silent=False):

""" Moment Matching method, which minimize the error term between an approximation and the defined moments. The method starts by initializing the parameters using a normal distribution

"""

# get covariance matrix

covar = Para_match[4][0]

# get starting parameters using a random normal distribution

x_ini = np.random.multivariate_normal(Para_match[0],covar,S_N).ravel() # initial guess is a multivariate normal distribution

# minimize the residuals

res = minimize(self.MomentMatchingFunc, x_ini, method='CG',args=(Para_match)) # method="CG",options={'maxiter':60, 'disp': silent}

# get results and format them as a matrix

scen = np.reshape(res.x, (-1, len(Para_match[0])))

return(scen)